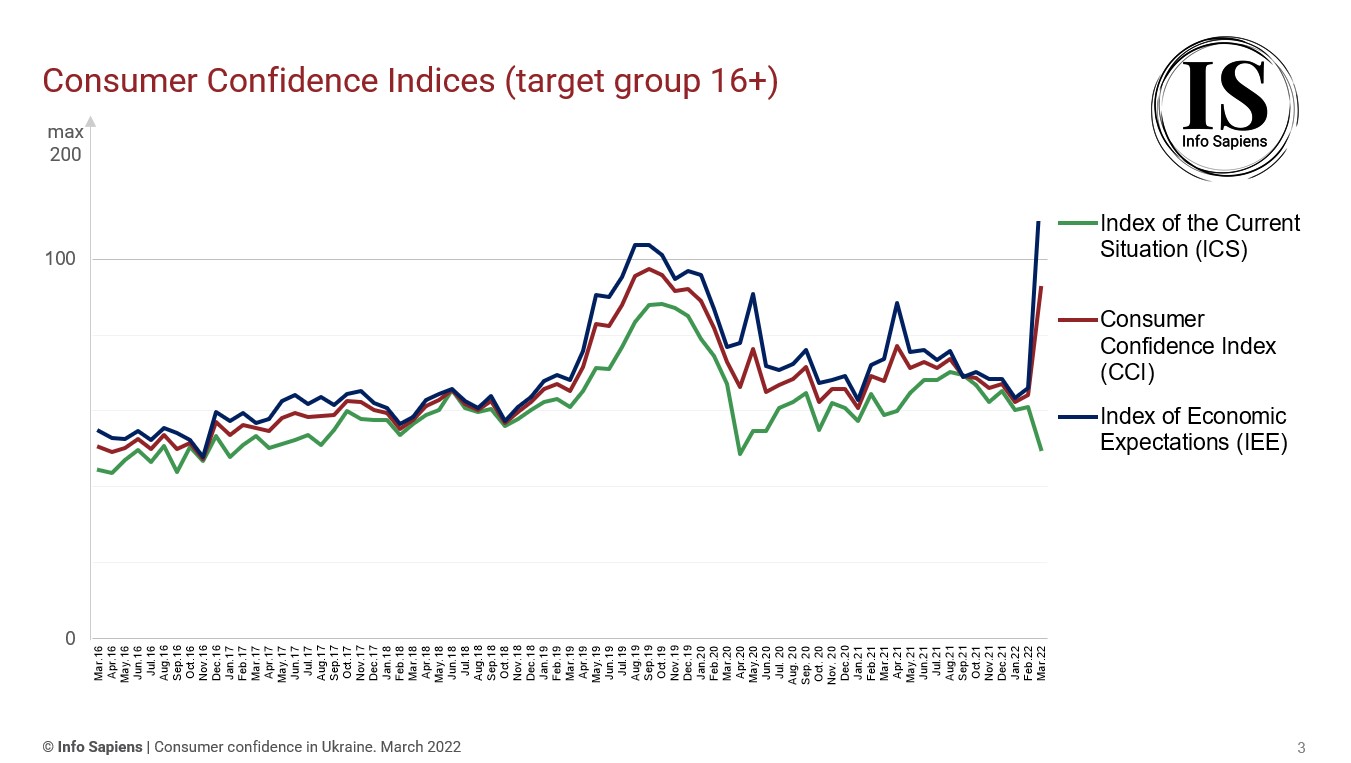

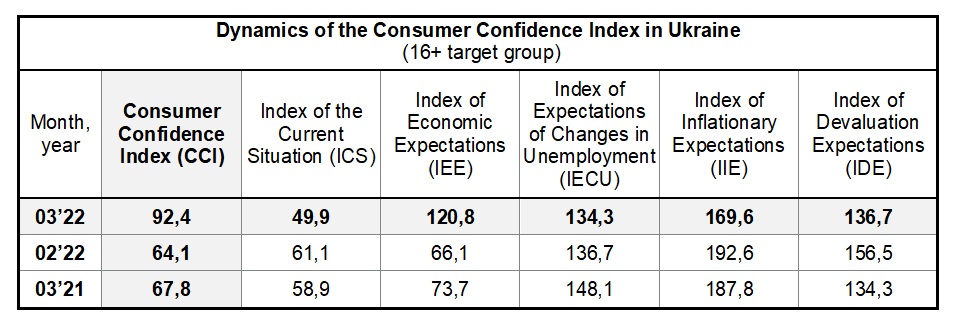

According to the data provided by Info Sapiens “Consumer confidence of Ukrainians”, conducted by Info Sapiens and financially supported by Dragon Capital, in March, 2022, the Consumer Confidence Index of Ukrainians has increased and equals 92,4 points. The increase in the indicator was caused by an increase in all of its components, except for the Index of Propensity to Consume, which decreased by 34.7 points.

In March 2022, the Consumer Confidence Index (CCI) equals 92,4, which is 28,3 points higher than the indicator in February.

Index of the Current Situation (ICS) have decreased and equals 49,9, which is 11,2 p. lower than in February. The components of this index have changed as follows:

- – Index of Current Personal Financial Standing (х1) equals 71,2, which is 12,4 points higher than the indicator in February;

- – Index of Propensity to Consume (х5) decreased by 34,7 p. to the level 28,6.

In March, Index of Economic Expectations (ІЕE) have increased and equals 120,8, which is 54,6 p. higher that the level of this indicator in February. The components of this index have changed as follows:

- – Index of Expected Changes in Personal Financial Standing (х2) equals 87,1, which is 20,2 points higher than in February;

- – Index of Expectations of the Country’s Economic Development Over the Next Year (х3) in March equals 116,1, which is 61,2 points higher than in previous month;

- – Index of Expectations of the Country’s Economic Development over the Next 5 Years (х4) increased by 82,5 points compared to last month and equals 159,1.

In March, the indicator of Index of Expectations of Changes in Unemployment has decreased by 2.3 points and equals 134,3. Index of Inflationary Expectations decreased by 23 point and equals 169,6. Expectations of Ukrainians regarding the hryvna’s exchange rate in the coming three months have improved: Index of Devaluation Expectations decreased by 19,8 p. and equals 136,7.

«In March, the consumer sentiment index is at the peak of measurements since 2014, approaching the values of autumn 2019, when it almost crossed the mark of 100, which would mean a transition to a positive assessment of the economic situation. This is paradoxical, given the war, but it happens due to the construction of the index and the expectations of Ukrainians. 2/5 of the CCI is impacted by the assessment of the current situation, which has fallen significantly during the war. It is now at the level of April 2020, when COVID-2019 began in Ukraine, and 2015-2016. But 3/5 of the index is affected by economic expectations for six months to five years, and they are out of scale, reaching 120.8. We have never seen such a thing. It corresponds to the fact that 92% of Ukrainians believe that Ukraine will be able to repel Russia's attack . At the same time, Ukrainians are more optimistic regarding economic development in the long run than in the short run.» - as Info Sapiens analysts comment.

How the indices are calculated

The survey «Consumer confidence in Ukraine» was conducted by GfK Ukraine since June 2000. From 2019 this project is provided by Info Sapiens. From January 2009 consumer confidence survey is conducted on a monthly basis.

In Ukraine. the Consumer Confidence Index is determined through a random survey of domestic households. The poll involves 1.000 individuals aged 16+. (Up to April 2014 the poll involved 1.000 respondents aged 15-59). A representative sample is selected by gender and age, also by type and size of settlement. In April 2014 Autonomous Republic of Crimea was excluded from the sample of consumer confidence research in Ukraine. The margin of error is 3.1%. In April and May 2020, as well as in April 2021 due to lockdown, and from March 2022 due to hostilities, the survey was conducted by telephone interview with calls to mobile numbers. Dates of the latest survey: March 2-28.

To define the CCI, respondents are asked these questions:

- 1. How has the financial standing of your family changed over the last six months?

- 2. How do you think your family’s financial standing will change in the next six months?

- 3. Looking at economic conditions in the country as a whole, do you think the next 12 months will be good or bad?

- 4. Looking at the next five years, will they be good ones or bad ones for the country’s economy?

- 5. In terms of large purchases for your home, do you think now is generally a good time or a bad time to make such purchases?

- • index of Current Personal Financial Standing (x1);

- • index of Expected Changes in Personal Financial Standing (x2);

- • index of Expected Economic Conditions in the Country Over the Next Year (x3);

- • index of Expected Economic Conditions in the Country Over the Next 5 Years (x4);

- • index of Propensity to Consume (x5).

- • consumer Confidence Index (CCI) as the arithmetic average of indices x1–x5;

- • index of the Current Situation (ICS) as the arithmetic average of indices x1 and x5;

- • index of Economic Expectations (IEE) as the arithmetic average of indices x2, x3, and x4.

- 1. Do you think that within next 12 months the number of unemployed (people who do not have job and are looking for work) will increase, will remain roughly the same, or will decrease?

- 2. How do you think that prices for major consumer goods and services will change in the next 1–2 months?

- 3. How do you think the USD value will change towards the UAH value during the next 3 months?

Each of these questions is related to a corresponding index:

Indices are constructed thus: the share of negative answers is deducted from the share of positive answers, and 100 is added to this difference in order to eliminate negative values. On the basis of these five indices, three aggregate indices are calculated:

Index values range from 0 to 200. The index equals 200 when all respondents positively assess the economic situation. It totals 100 when the shares of positive and negative assessments are equal. Indices of less than 100 indicate the prevalence of negative assessments. To determine the Index of Expected Changes in Unemployment (IECU), the Index of Inflationary Expectations (IIE) and the Index of Devaluation Expectations (IDE), the respondents are asked these three questions:

The IECU, the IIE and the IDE are calculated thus: the share of answers that indicate a decrease of unemployment/inflation/devaluation is subtracted from the share of answers that indicate the growth of unemployment/inflation/devaluation, and 100 is added to the difference to eliminate negative values. The values of indices can vary from 0 to 200. The index totals 200 when all residents expect an increase in unemployment/inflation/devaluation.