48% of foreign investors think that Ukraine became less attractive for investment, 42% consider the investment climate largely unchanged, and only 9% see improvements.

These are some of the findings of the fifth annual survey of strategic and portfolio investors jointly conducted by the European Business Association (EBA), Dragon Capital, and Center for Economic Strategy (CES) at the end of October 2020.

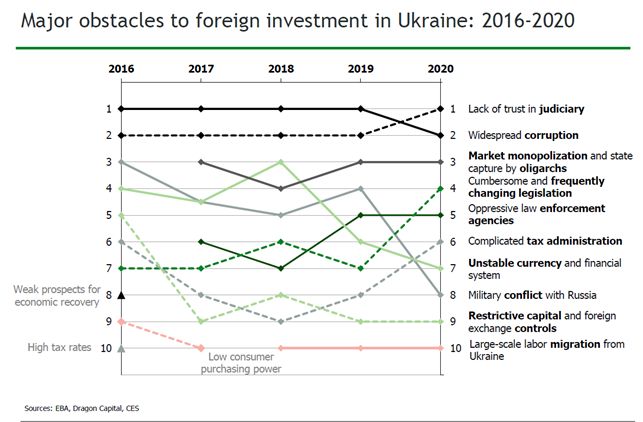

The “lack of trust in judiciary” was named the main obstacle to foreign investment for the first time in five years, while “widespread corruption”, the previous leader, moved to second place. The same obstacles were named by both portfolio and direct investors.

Market monopolization and state capture by oligarchs was the #3 impediment, though strategic investors were also concerned about cumbersome and frequently changing legislation.

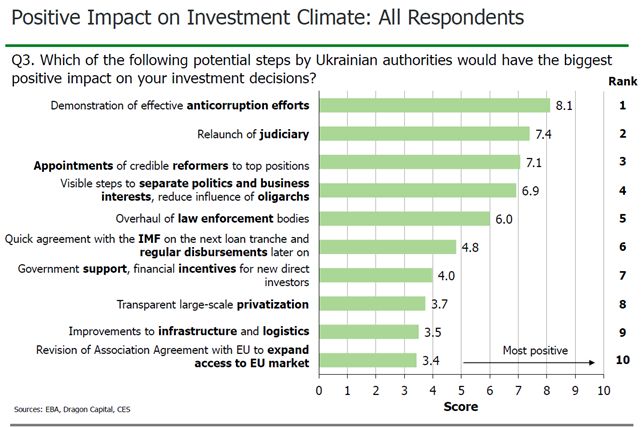

Effective fight against corruption was viewed as the top priority for improving the investment climate by all investors, followed by the relaunch of judiciary and appointment of credible reformers to top positions.

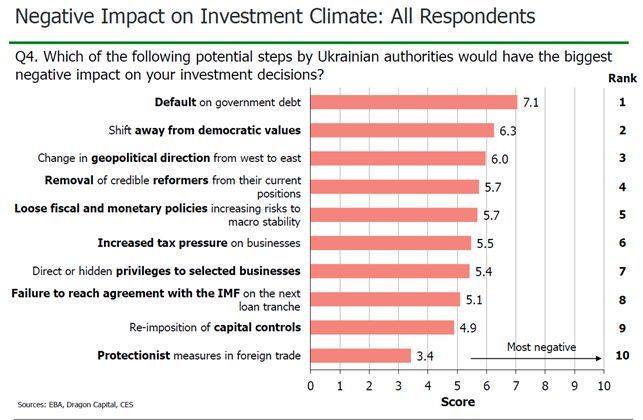

In the meantime, debt default is considered the top threat to the investment climate, followed by a shift away from democratic values and change in geopolitical direction from west to east. Strategic investors also view loose economic policies as an important negative factor, while portfolio investors would negatively react to failure to reach agreement with the IMF on the next loan tranche.

The investor community is resilient to a potential new coronavirus lockdown. 47% of the strategic investors already working in Ukraine think that a repeat lockdown will not affect their investment plans, while 27% would reduce or stop investments.

“The Ukrainian business shares the opinion of foreign investors. According to an EBA survey conducted in September, most CEOs think that Ukraine needs to implement judicial reform and establish the rule of law first and foremost, with fight against corruption following in second place. At the same time, recent events around the Constitutional Court do not contribute to our attractiveness as an investment destination. On the contrary, our international partners may raise questions as to whether Ukraine is actually a reliable partner for cooperation under the circumstances. Honestly, the business community was concerned about this incident. The business and general public in Ukraine have long looked forward to political and economic stability underpinned by a fair judiciary and tamed corruption. Therefore, I call on the authorities to finally start active and effective work toward making these changes,” said Anna Derevyanko, Executive Director, European Business Association.

Tomas Fiala, CEO of Dragon Capital and President of the European Business Association, said “Last year, we hoped for quick market reforms, fair punishment for corruption, and a relaunch of government institutions through attracting professionals with strong moral convictions. Over the past six months, however, these hopes have given way to frustration over dubious personnel policies favoring oligarchs and corrupt officials”.

“The lack of trust in judiciary came out on top among obstacles to investing in Ukraine for the first time in five years. This confirms that without a genuine reset of the judicial system under the control of the public and international partners, any government attempts to attract investment and boost the economy are doomed to failure,” said Hlib Vyshlinsky, executive director of the Center for Economic Strategy.

Reference:

The survey was conducted by the European Business Association (EBA) and investment bank Dragon Capital with analytical support from Centre for Economic Strategy between October 26-30, 2020. A total of 117 respondents, including portfolio and direct investors and those already invested or planning to invest in Ukraine, participated in the online survey. The survey was conducted in the form of online questionnaire with assistance from Info Sapiens.

The European Business Association (EBA) is one of the largest business communities in Ukraine, founded with the support of the European Commission in 1999. The EBA gives domestic companies the opportunity to contribute to improving the investment climate in Ukraine in favor of business industries, society, and the country as a whole.

Dragon Capital is a leading Ukrainian group of companies in the field of investment and financial services, offering a comprehensive range of products in equities and fixed income sales, trading and research, investment banking, private equity and asset management to corporate and private clients.

Centre for Economic Strategy (CES) is an independent economic policy think tank founded in May 2015. Its objective is to support reforms helping to achieve sustainable inclusive economic growth in the country. The Centre contributes to the development of Ukraine's economic growth strategy, conducts independent analyses of the most important aspects of public policy and builds public support for reforms.